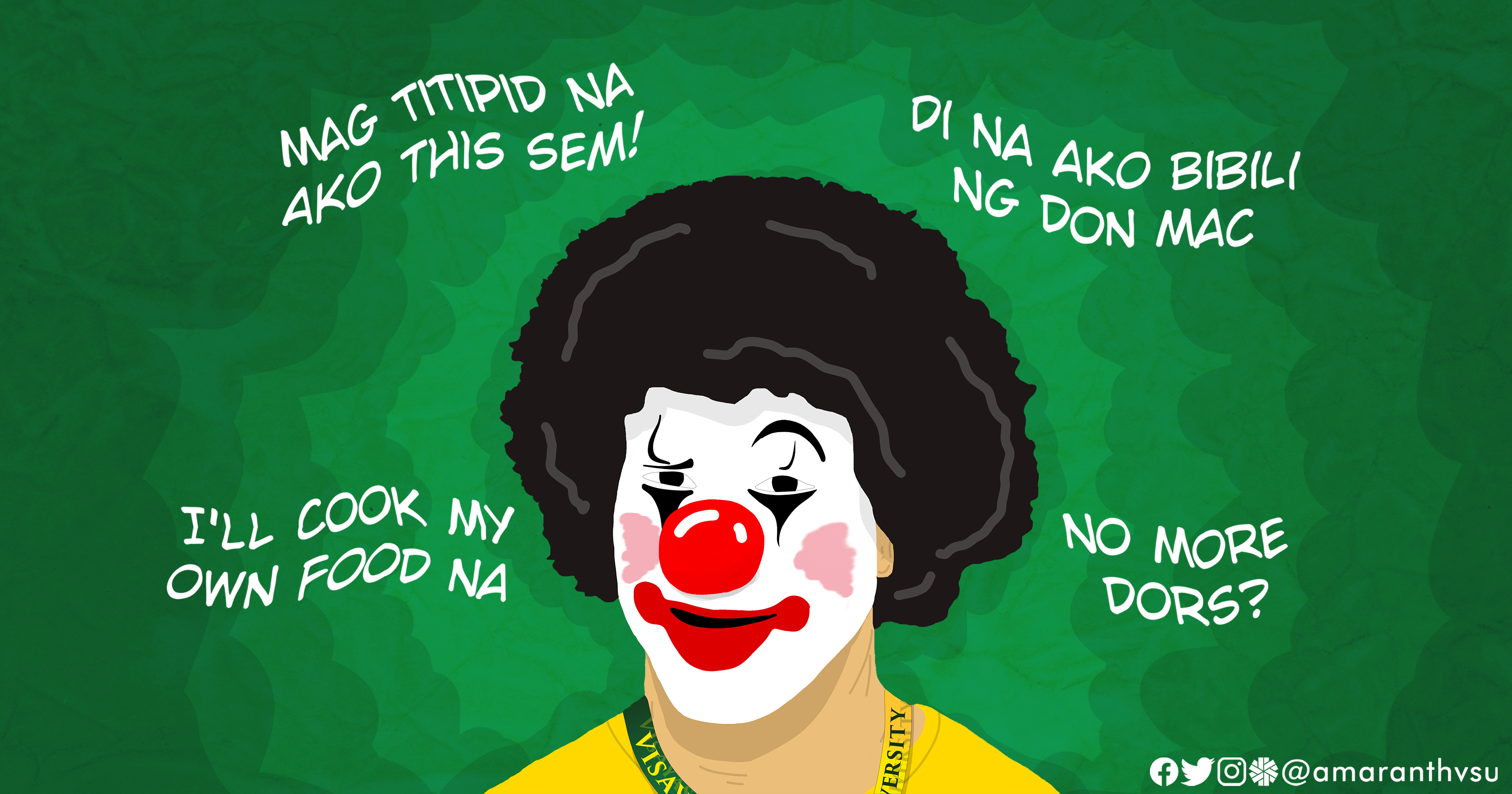

Am I managing my allowance, or is my allowance managing me?

Explore the delicate balance between budgeting and financial independence. Delve into practical tips and insights to regain control and make the most of your resources.

Graphics by Bien Christoper Elizaga

Every college student at VSU has surely experienced the dilemma of managing their daily, weekly, and even monthly allowance. With the consistent increase in the price of goods in the market, students are always challenged to adjust their preferences to match their budget; it is a harsh reality that every Viscan struggles to face. A lot of students even go to extreme measures just to save money, such as skipping meals, and even resorting to unhealthy saving habits due to stress brought on by a limited allowance. With this in mind, let us look at different strategies to save money without having to compromise your health.

If you’re a freshman, for sure you’ve heard of the 5 pesos per cup of rice here at VSU. Imagine a cup of rice that cheap in this Philippine economy; of course, you’ll be thinking that your seniors were really able to save a lot of money. Way back before the pandemic, your 500 pesos could last for a week. However, with the economy now, you’ll be lucky if your 500 pesos can last half the week. But don't be discouraged because your allowance can still last long enough if you practice healthy allowance management.

Here are some tips for you to manage your allowance effectively:

- Allocate a daily budget.

The best way for your weekly allowance to last for a week is to budget it based on your daily expenses. Knowing how much you can spend per day will surely help you make smart decisions about managing your finances. There are a lot of goods available in the market that are truly tempting for us, and there are moments of weakness when we cave in and buy that bottled carabao chocolate milk and pair it with banana cue. While it is okay to treat ourselves to things we deserve, it is still important to make sure that we’re managing our allowances wisely. Be mindful of your spending.

- Cook your own meal

While cooking may seem like a chore, preparing your own meals is a cost-effective choice. Eating out frequently can accumulate expenses rapidly, so invest time in cooking your meals. Once you appreciate the process, preparing your own food can become a therapeutic and money-saving activity.

- As much as possible, choose to walk.

Walking is part of the Viscan identity. Walking instead of commuting, especially over short distances, can help you save money. A motorcycle ride can cost you 10–20 pesos, depending on the distance; that amount of money can already be used to buy other necessary things. Always bring your umbrella, because if you don’t have one, you can easily be tempted to ride a motorcycle and pay for transportation expenses that could’ve been saved if you had an umbrella.

- Bring your own water.

Navigating the expansive Visayas State University campus can be tiring, especially under the scorching sun. One of the most necessary tools for saving money is your tumbler. Always fill it with water. Sometimes, you’re not really hungry; you’re just thirsty.

- Resist Splurging.

We can’t deny this, but we really love to say "Deserve ko ‘to" whenever we are about to purchase something out of the budget to satisfy ourselves. Well, who can we blame? We really deserve to treat ourselves after a stressful project, quiz, and exam. But sometimes we get ahead of ourselves and spend too much money in one sitting. If you wish to avoid splurging, ask yourself first if it’s a need or a want.

The strategies shared above serve as valuable tools to maintain a balanced financial outlook in the face of inflation and limited resources. By implementing practical strategies such as budgeting, cooking at home, walking, carrying your own water, and resisting impulse spending, students can not only stretch their allowances further but also cultivate a sense of financial responsibility that will serve them well beyond their college years. This involves making informed financial decisions and ensuring that their allowance works to enhance their overall well-being rather than be a source of stress. Remember to be mindful when managing your allowance, so your allowance won’t be the one managing you.

Related Stories

Amaranth Frequently Asked Questions (FAQs)

"Amaranth Frequently Asked Questions (FAQs)" addresses common queries about Amaranth, providing concise and informative answers to help users better understand its features and uses.

Inside the mind of an upcoming 4th-year student in this pandemic

"Inside the Mind of an Upcoming 4th-Year Student in This Pandemic" provides a glimpse into the unique challenges, thoughts, and experiences of a student approaching their final year amidst the ongoing pandemic.

ML50: Remembering the Martial Law Victims

"ML50: Remembering the Martial Law Victims" reflects on the 50th anniversary, acknowledging the impact and honoring the victims of Martial Law through poignant remembrance.

Santa's shopee xpress

"Santa's Shopee Xpress" unfolds a whimsical tale, blending the magic of Santa's world with the convenience of modern e-commerce, creating a delightful prose adventure.